24+ salary calculator idaho

The income tax rate ranges from 1125 to 6925. No state-level payroll tax.

Isdb Financial Aid Csv At Master Tommulholland Isdb Github

Web Idaho Hourly Paycheck and Payroll Calculator.

. This results in roughly 3654 of. Web 23 rows Living Wage Calculation for Idaho. Housing food healthcare transportation and energy.

Web The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Well do the math for youall you need to do. Use ADPs Idaho Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web Living Wage Calculation for Boise County Idaho. Web Calculate your Idaho net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Free for personal use. Now is the easiest. Web Net Pay Calculator The Net Pay Calculator is used by State of Idaho employees to estimate the impact of a change to pay rate hours worked deductions withholdings.

Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web The Income Tax calculation for Idaho includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Idaho State Tax Tables in 2023 Federal. Web Salary Paycheck Calculator.

Web The Idaho Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home. Web Paycheck Calculator Idaho - ID Tax Year 2023.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Idaho. Last Updated on March 15 2023 Enter your period or annual income together with the necessary federal state and. Need help calculating paychecks.

Housing food healthcare transportation and energy. 2445 2961 Poverty Wage. Web Filing 2500000 of earnings will result in 50071 of your earnings being taxed as state tax calculation based on 2022 Idaho State Tax Tables.

These are the typical annual salaries for various. 653 880 1107 1334 880. Your average tax rate is 1167 and your marginal tax rate is 22.

Web Free Paycheck Calculator. Examples of payment frequencies include biweekly semi-monthly. Web Idaho Income Tax Calculator 2022-2023.

If you make 70000 a year living in Idaho you will be taxed 11368. Web The median household income is 52225 2017.

7980 Hidden Springs Dr Helena Mt 59602 Zillow

Monthly Gross Basic Pay Of Workers In Public Day Care Centres 2018 Download Table

Idaho Income Tax Calculator Smartasset

Idaho Paycheck Calculator Tax Year 2023

Idaho Paycheck Calculator Smartasset

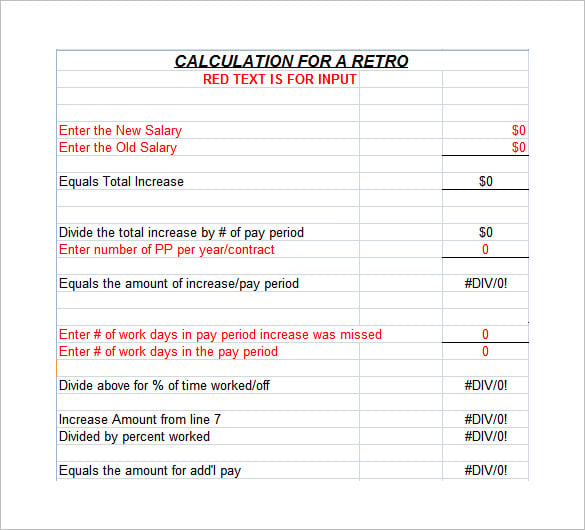

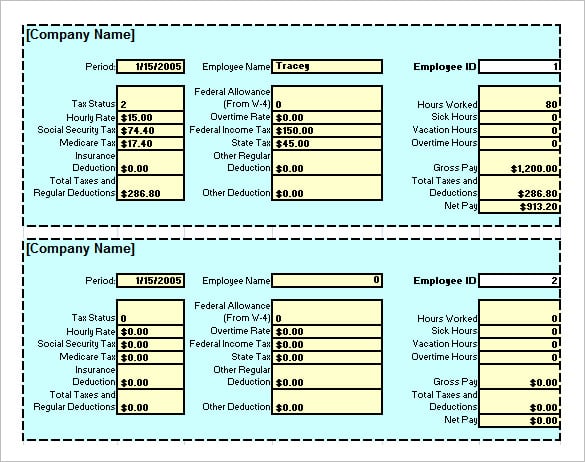

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Steinberg Nuendo Live Euro Unit

Paid Time Off Pto Policy Guide Free Template

Fall Marketing Edition Livestock Market Digest By Livestock Publishers Issuu

800 N Delaware St San Mateo Ca 94401 Usa 12 Unit Rentals Zumper

Scholarship Amount Deadline Qualifications Website 2021 New Century Scholarship 1250 Per Semester Up To Four Semesters 9 1 2022

Idaho Income Tax Calculator Smartasset

8 Salary Paycheck Calculator Doc Excel Pdf

112916 Daily Corinthian E Edition By Daily Corinthian Issuu

Boom Fantasy Promo Code Review 100 Risk Free Bet

3555 Velda Oaks Cir Tallahassee Fl 32309 Zillow

8 Salary Paycheck Calculator Doc Excel Pdf